TRADE SETUPS - TradeTheMBI1

Main menu:

TRADE SETUPS

Trade Setups Using the DOC

CYAN PIVOT SETUP AND DETAILS

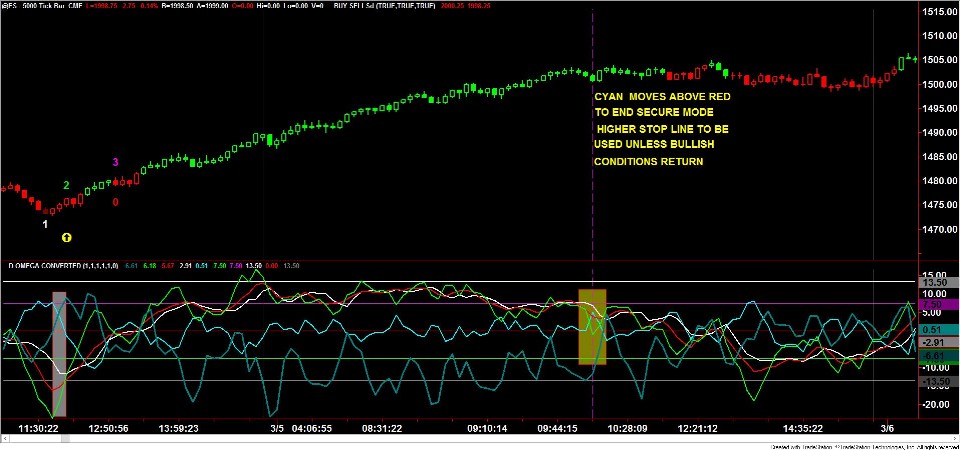

The below image depicts E-

Cyan Pivot Buy Signal

Cyan Up Pivot below negative 6.85 (-

6.85) (Normal Set Up) Red DOC is Rising (See Slideshow)

If Steel DOC is greater than 13.5 (> +13.5) Wait 2 bars for Entry. This Special Setup occurs occasionally.

Profit Target is +3.5 Points

Stop Loss is equal to 4 Points from Entry

Green Pivot numbers above price indicate Cyan is above Red at signal

Yellow Pivot numbers above price indicate Cyan is below Red at signal (More Bullish configuration)

Green DOC above +13.5 very rare indicates exhuastion push, use caution and tighten stop sooner.

1,2,3 Buy

8 Point Stop, Target is Following the ABM Stop

Multiple Contracts after achieving 2.5 points lock in a gain